Feed the World, Make Money

Opportunities abound in feeding the world, from farmland to irrigation to processing crops to boosting the nutritional content of basic foods.

The outline of the story rests on a couple of estimates: a 30%

increase in world population by 2050, which would necessitate a 70%

increase in food production. Even if those numbers turn out to be only

close-to-right, they provide a reliable base to build on,

investment-wise.

Although this story is a long-term one, there are a few things

happening right now that make opportunities in agriculture more urgent.

On this topic, my friend Brad Farquhar at Assiniboia Capital in Regina,

Saskatchewan, sent me a couple of interesting things over the weekend.

Assiniboia Capital manages the largest farmland fund in Canada. As such,

Brad is a great source of insight on agricultural markets. I’ve quoted

him many times over the years.

Anyway, Brad sent over a newsletter called the Global AgInvesting Quarterly.

The letter’s main story is on drought and how it will impact harvests

this year. The US just had the worst drought in 50 years. Citing the US

Drought Monitor, at the end of August, GAI Quarterly notes:

- 53% of the US was in moderate drought or worse.

- 65% of US farms were in areas of drought.

- 70% of crop and livestock production were in areas of moderate or worse drought.

As a result of these severe drought conditions, the USDA recently cut

harvest forecasts for corn and soybeans by 25% and 18%, respectively.

But it is not just the US that Old Man Drought has drained dry.

Russia, India and the EU are all struggling with dry weather as well.

The GAI points out that drought in Russia will slash this year’s wheat

harvest by one quarter, while drought in Southern Europe will reduce the

corn and soy crops in Serbia and Bosnia by at least 50%. In India, this

year’s dry monsoon season has reduced the nation’s rise crop by 6%,

compared to last year. GAI Quarterly speculates, with evidence both

anecdotal and empirical, that we’ll see more dry weather in the US Corn

Belt — a continuation of a near-term trend.

Meanwhile, the blistering heat that has been a bane to US agriculture

has been a boon to Canadian agriculture. Warm weather across the

Canadian Prairies has created more prime farming acreage. Brad reports

on successful corn and soybean plantings for the first time in

Saskatchewan. Brazil is another area that has escaped drought with

expected record corn and soybean production.

Dealing with drought means more opportunity for irrigation.

On both occasions, the recommendation produced a double. I think the

stock is pricey now, but it is one to watch and grab after the next leg

down.

Another stock that plays well with the demand for food is Alliance Grain Traders (AGT:tsx; AGXXF:otcbb).

The stock has slipped recently and is below book value of C$13.86 per

share and pays 60 cents annually in dividends. At today’s price, that’s

4.7%.

Alliance, you may remember, processes staple foods like lentils,

beans and chickpeas — called “pulses.” The company’s headquarters are in

Regina, Saskatchewan. (Brad is a shareholder, by the way.) Alliance has

facilities in the US, Turkey, South Africa, Australia and China. Long

term, I’ve always liked the story here, and my enthusiasm is not

diminished by the stock’s tough slog since I recommended it in the

summer of 2011.

I visited with the company that summer and have had subsequent

discussions with CEO, Murad Al-Katib. Murad always emphasizes his bigger

vision for Alliance as a food ingredients company. On its website,

Alliance recently posted an excellent presentation that really focused

on this aspect of the company. I would like to share some highlights

with you here.

Pulses have much to recommend them. In a world where water is a

constraint, it takes much less water to produce a pound of pulses than

other foods.

Take a look at how many gallons of water we use to produce the following foods:

• 1,857 gallons/lb of beef

• 756 gallons/lb of pork

• 469 gallons/lb of chicken

• 368 gallons/lb of peanuts

• 216 gallons/lb of soybeans

• 43 gallons/lb of pulses

• 756 gallons/lb of pork

• 469 gallons/lb of chicken

• 368 gallons/lb of peanuts

• 216 gallons/lb of soybeans

• 43 gallons/lb of pulses

Pulses, as you see, use the least amount of water. They are also high

in protein and fiber, nutrient dense, low fat, gluten free and non-GMO.

Pulses also make their own fertilizer by fixing the nitrogen in the

soil and require half the nonrenewable energy to produce, compared to

crops like wheat. Growing pulses, therefore, also lowers carbon

emissions.

Food producers are starting to appreciate these things, as Murad

predicted they would. I remember sitting in an Italian restaurant with

Murad while he explained how one day food companies would mix pulses

with wheat to make pasta. Well, that day has arrived.

Food companies are now making flour with pulses and mixing it to make

not only pastas, but baked goods, snack foods and other packaged goods.

Doing this allows them to boost the nutritional content of many foods.

Look closely at the photo below, for example, especially the

ingredients.

Yes, “legume flour blend” — you’ll see more of this, I guarantee it.

And once one food producer like Barilla does it, they’ll all follow

suit. After all, they can’t let a competitor make all those claims about

their healthy pasta, while they stick to old-fashioned wheat flour!

Already, a number of food companies have declared ambitious goals:

PepsiCo wants to reduce its water use in five years. Heinz wants to

reduce carbon emissions by 20% by 2015. Wal-Mart, Carrefour, Tesco and

others are all tracking things like water use and carbon emissions.

Products that can help them meet those goals — like pulses — will get

more attention.

So this is an exciting story. As Alliance is a global leader in

processing pulses, it should see plenty of business in the years ahead.

Traditionally, the markets of South Asia, Latin America and the Middle

East and North Africa have been the main drivers. But the new emphasis

on pulses as a food ingredient, and a water-efficient, protein-rich

crop, opens up new markets in Europe, the US and China.

Meanwhile, Alliance has a global network second to none, which Murad

and his team have put together over the last dozen years. This network

gives it tremendous advantages in market intelligence, logistics, market

diversification and its ability to manage risks.

The company has a great future. I have a lot of confidence in the

management team, particularly its founder-in-chief, Murad Al-Katib.

Insiders own a third of the stock. And I can tell you that Murad takes

it personally that his stock is beaten up so badly. He is motivated to

make good for his shareholders (of which he is one, and he has most of

his net worth invested in Alliance).

Alliance is a buy and a long-term core holding. Buy some, sit on it, collect the dividend and watch the story unfold.

Regards.

Invest In Agriculture- Five Reasons To Start Today

In some ways, farmland is even better than gold or silver. At least farmland is an intrinsically useful thing. It provides a tangible yield in the form of good things from the earth. We all have to eat. As consumers trim their sails, they ‘ll give up a lot before they give up their calorie intake. In fact, worldwide, the per capita calorie intake is likely to rise, while quality soil will become a scarce commodity. Altogether, I see five big reasons why agriculture investments are as good as green gold…

Invest In Agriculture: Reason #1

Grain inventories are falling to their lowest levels in more than 40 years

Obviously, we can’t continue to dip into inventories. The natural response you would expect to see is rising prices for grains and for the farmland that produces them. Global grain inventories, drought pending, are expected to rise this year, but will still remain well below historical level.

The big thing to keep your eye on here is stocks-to-use ratio. That compares the amount we have on hand to the amount we’re using. The higher the number, the closer we are to having fully stocked granaries. In the case of big commodities like corn, wheat and soybeans, the cupboard’s pretty bare. Based on USDA numbers, the stocks-to-use ratio for 2008-2009 looks to be the second lowest in history.

U.S. ending stocks are projected to nearly double, going from 7 million metric tons to nearly 14 million metric tons. Many countries, even grain powerhouse Argentina, are still holding onto local supply by restricting exports.

Mark McLornan made this comparison in the May issue of Marc Faber’s Gloom Boom & Doom Report: Investing in agriculture today will be like investing in the oil sector in 2001-2002. (If you’ll remember, that’s when oil raced up to $143 a barrel from its $30 low.) Right now, this sector remains locked in underinvestment, so there’s opportunity here, considering the case of future demand.

Invest In Agriculture: Reason #2

Grain consumption is on the rise

The world consumes, on average, 2,600 bushels of grain crop per second. That’s almost twice what we ate back in 1974. And that amount could easily double to 5,200 bushels per second over the next 20 years. The amount of pressure on the global food supply network is enormous. You can see the steep downward trend in wheat supply in the chart below.

Why are we eating so much more grain? The big factor here is meat. Hundreds of millions of people in China and India are joining the middle class. As people get wealthier they eat more meat. And more meat requires more grains to feed cattle and hogs. It takes 10 pounds of grain to produce one pound of meat. Because of that, most of the demand growth for coarse grain and oilseed meal will come from livestock in developing economies or the countries feeding them. So long as the middle class expands, you can be sure meat and grain consumption will follow.

The Boom Has Only Just Begun

Invest In Agriculture: Reason #3

Biofuels are driving ag demand up to new levels

Most every oil-consuming country has biofuel targets in place that will kick in over the next five years. These places include the U.S., the EU, Canada, Japan, Brazil, India and China. To meet their targets, according to work by Agcapita, we‘ll have to commit some 240 million acres to biofuel production. That represents about 50% of the arable land in North America and about 6% of all the arable land in the world.

Let’s consider ethanol alone for a moment, courtesy of some World Bank stats. From 2004-2007, U.S. biofuel use increased by 50 million tons, while world production increased only 51 million tons. That leaves only 1 million tons left over to cover a 33 million ton increase in the rest of corn demand the world over.

Meaning we didn’t cover usage and caused the price to rise. By 2008, U.S. farmers were already planting every available acre with corn, the second biggest planting in 60 years, and producing one of the largest corn crops in history.

This helped push U.S. farmland values up to new record highs. Massachusetts farmland fetched the highest price at $12,200 per acre. As you can see, the biofuel craze puts more pressure on farmland demand. And, there are other pressures as well…

Invest In Agriculture: Reason #4

Arable land per person is falling

We are losing quality topsoil faster than we are replacing it. Quality soil is loose, clumpy, filled with air pockets and teeming with life. It’s a complex microecosystem all its own. On average, the planet has little more than three feet of topsoil spread over its surface. The Seattle Post-Intelligencer calls it the shallow skin of nutrient-rich matter that sustains most of our food. Replacing it isn’t easy. It grows back an inch or two over hundreds of years.

This is not lost on certain farseeing investors. Jeremy Grantham, the curmudgeonly head of the money manager GMO, recently told his clients: Our farmers are in the mining business! Yes, the soil is incredibly deep, but it is still finite. For every bushel of wheat produced, we lose two bushels of topsoil.

We lose topsoil to development, erosion and desertification. Globally, it’s clear we are eroding soils at a rate much faster than they can form, notes John Reganold, a soils scientist at Washington State University. Estimates vary, but in the U.S., the National Academy of Sciences says we’re losing soil 10 times faster than it’s being replaced. The U.N. says that on a global basis, the rate of loss is 10-100 times faster than that of replacement.

In any case, it seems safe to say that good dirt is in short supply. This ensures a growing scarcity of good farmland, and plenty of countries including Saudi Arabia, China, and South Korea, that will pay for it at any price.

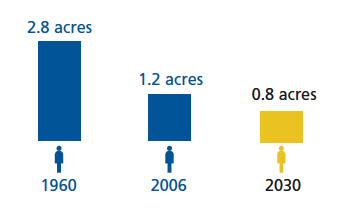

This little graphic below summarizes where we are in terms of arable land per person. For the first time ever we’re in danger of slipping below one acre per person:

Of course we don‘t need 2.8 acres per person anymore, because of

advances in agriculture over time. But gains in yield per acre are

slowing. Over the last 40 years, we’ve increased the yield per acre by

2.1% per year. But the pace of those gains is slowing. Since 2000, the

increase in yields per acre has averaged less than 1% per year.

We may see new innovations in seeds or other technology that we can scarcely imagine now. But any solution will take time and money to implement. Meanwhile, the world’s agriculture markets just get tighter and tighter…

Invest In Agriculture: Reason #5

Low water supplies cut down farm productivity

China is a biggie to watch when it comes to food supply dynamics. It feeds 20% of the world’s population on only 10% of the world’s arable land and with only 6% of its water. China’s water tables are falling too. In parts of its traditional breadbasket in the north production of wheat and corn is in jeopardy. Chinese officials are well aware of this urgent need.

As the Financial Times reports: The country is investing heavily in agriculture. Its agriculture budget increased 27% in 2007, 38% in 2008, and about 20% in 2009. No other big country, barring India, has increased spending on farming so much, says the FT. Still, increasing output will be a challenge.

One British study suggests that if China imports to meet just 5% more of its grain demand, it could swallow all the world’s exported grain. In 2007 and 2008, China imported practically zero wheat. However, today imports are on the rise, sometimes increasing over 100% from month to month. Part of that’s due to drought, which we can expect a lot more of in China as the years roll on and the water table decreases even more.

It also means that any way to secure better water supplies will be worth its weight in gold. Growing crops and keeping livestock hydrated uses three-quarters of the world’s water. That’s a lot of water, and China already doesn’t have enough.

A United Nations report puts it in stark terms: The population of China, India, Pakistan, and other big Asian countries will grow 1.5 billion by 2050, doubling the continent’s food demand. Some of the best returns this decade will come from agriculture investing, and the kinds of companies that keep us supplied with water, food, and energy. Position your portfolio accordingly.

Thank you for reading

We may see new innovations in seeds or other technology that we can scarcely imagine now. But any solution will take time and money to implement. Meanwhile, the world’s agriculture markets just get tighter and tighter…

Invest In Agriculture: Reason #5

Low water supplies cut down farm productivity

China is a biggie to watch when it comes to food supply dynamics. It feeds 20% of the world’s population on only 10% of the world’s arable land and with only 6% of its water. China’s water tables are falling too. In parts of its traditional breadbasket in the north production of wheat and corn is in jeopardy. Chinese officials are well aware of this urgent need.

As the Financial Times reports: The country is investing heavily in agriculture. Its agriculture budget increased 27% in 2007, 38% in 2008, and about 20% in 2009. No other big country, barring India, has increased spending on farming so much, says the FT. Still, increasing output will be a challenge.

One British study suggests that if China imports to meet just 5% more of its grain demand, it could swallow all the world’s exported grain. In 2007 and 2008, China imported practically zero wheat. However, today imports are on the rise, sometimes increasing over 100% from month to month. Part of that’s due to drought, which we can expect a lot more of in China as the years roll on and the water table decreases even more.

It also means that any way to secure better water supplies will be worth its weight in gold. Growing crops and keeping livestock hydrated uses three-quarters of the world’s water. That’s a lot of water, and China already doesn’t have enough.

A United Nations report puts it in stark terms: The population of China, India, Pakistan, and other big Asian countries will grow 1.5 billion by 2050, doubling the continent’s food demand. Some of the best returns this decade will come from agriculture investing, and the kinds of companies that keep us supplied with water, food, and energy. Position your portfolio accordingly.

Thank you for reading

No comments:

Post a Comment